Example: High winds topple a tree onto your roof. This coverage could help pay for roof repairs or a new roof. Tree removal may also be covered.

What does homeowners insurance typically cover?

Homeowners insurance helps you pay for repairs when something unexpected — like wind, lightning or a fire — damages your home or belongings. It also can help you pay costs if you’re responsible for accidental property damage or bodily injury to others. Exactly what homeowners insurance covers varies from policy to policy, depending on the coverage you choose.

Learn more about homeowners insurance.

Standard homeowners coverages

Dwelling coverage

Dwelling coverage (Coverage A) helps you pay for repairs to your home and structures permanently connected to your home if an unexpected event that’s covered by your policy, such as a fire, windstorm, lightning or hail, causes damage. This can include some kinds of water damage, but not all.

Other structures coverage

Other structures coverage (Coverage B) helps you pay to repair or replace structures that aren’t connected to your home, like a fence or shed, if they’re damaged by a covered event.

Example: A heavy load of snow caves in the roof of your toolshed. This coverage could help with the cost of repairing the shed. (If belongings inside the shed are damaged, personal property coverage could help pay for repairing or replacing them.)

Personal property coverage

Personal property coverage (Coverage C) helps you repair or replace your personal belongings if they are stolen or damaged.

Example: Burglars break in and make off with your computer, jewelry and mountain bike. This coverage could pay you what they’re worth, or, depending on the type of coverage you select, the cost of replacing them.

Loss of use coverage

Loss of use coverage (Coverage D), also called additional living expenses coverage, can help you pay to stay elsewhere if your home is uninhabitable because of damage caused by a covered event.

Example: Extensive repairs are needed after a fire guts your home. This coverage could help you pay to rent a home, condo, or apartment while repairs are made.

Personal liability coverage

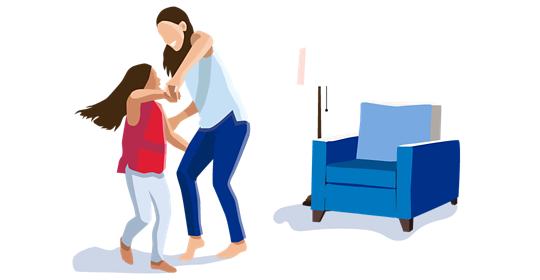

Personal liability coverage (Coverage E) can help pay costs if you’re responsible for accidental property damage or bodily injury to others.

Example: If your teenager hits a ball through a neighbor’s window, this coverage could help pay for a new window. Or if a guest slips on your icy sidewalk and hits their head, the coverage could help with medical bills and even legal bills from a lawsuit.

Medical payments to others coverage

Medical payments to others coverage (Coverage F) provides limited coverage for medical costs if someone outside your household is injured on your property, no matter whose fault it is.

Example: If a neighbor’s child breaks his arm while playing in your yard, this coverage could help pay for the trip to the emergency room.

Optional coverages

Dozens of optional coverages allow you to add coverage where you want it most. These are just a few; a Farmers® agent can help you understand the coverages available for your home and your life.

Water backup and sump overflow coverage

Water backup and sump overflow coverage can help with repair costs when water enters your house because of a sewer or drain backup or a sump pump overflow.

Example: A sudden storm overfills the sewer outside your home and the overflow surges into your basement, damaging the flooring, hot water heater and tools. This coverage can help with repair and replacement costs.

Valuable item coverages

Valuable item coverages allow you to raise the limits on items you own that wouldn’t be fully covered under the limit you picked for your personal property coverage.

Example: You inherit expensive artwork and jewelry and want to be sure they’re adequately covered. This coverage lets you raise limits on specific items or on unspecified items.

Identity fraud expense coverage

Identity fraud expense coverage reimburses you for costs associated with identity restoration.

Example: Your identity is compromised online and you have to spend considerable time and money to reestablish a secure identity and restore your credit. This coverage helps with costs.

Matching of undamaged property coverage

Matching of undamaged property coverage helps pay the cost of making repaired or replaced property look substantially the same as similar parts of your home that weren’t damaged.

Example: A storm wrecks 30% of your home’s siding. But the replacement siding doesn’t look the same as the undamaged siding. This coverage would help you replace undamaged siding to match the repair.

Residence glass coverage

Residence glass coverage is a waiver of the deductible on replacement of glass in your home if it’s broken accidentally.

Example: Your kid hits a baseball through a sliding glass door. This coverage can help you pay for a replacement door without having to pay your dwelling coverage deductible.

Typically covered perils

A peril, in insurance language, is a cause of loss or damage to your home, your property or your belongings. Insurance policies typically cover damage caused by perils such as:

- Fire

- Vandalism and theft

- Lightning strikes

- Wind

- Hail

- Explosions

- Falling objects

- The weight of snow or ice

What perils aren’t covered?

Flooding and earthquakes are not covered by standard homeowners policies. Beyond these events, what’s covered — or not covered — depends on your policy. Typically, policies will either list all perils that are covered (known as a “named perils” policy), or they will cover all perils except those specifically excluded (an “open perils” policy). Open perils means you're covered for a lot more causes of loss, but it also means you've got a much longer list of exclusions. Common excluded perils include wear and tear or neglect, pest infestations, mold (in many cases), intentional acts, war and governmental action.

Related articles

Buying Home Insurance? Make Sure Your Valuables Are Covered

One of the biggest mistakes consumers can make is to assume all your valuables will be covered automatically. You may have to add some items separately to your policy. These items could include valuables like jewelry, a coin collection, fine furs and more.

What Does Homeowners “Replacement Cost” Mean?

Replacement cost is the total cost to rebuild your home just as it stands today. It takes into account current construction techniques, prices for labor and materials, and the location of your home.

How Much Homeowners Liability Coverage Should I Consider?

When you’re considering how much homeowners liability coverage you may want, think about your entire net worth. Liability coverage is often aligned with the value of all of your assets — not just your home.

What is Umbrella Insurance?

The name can be confusing. It comes from how the policy works to provide coverage for your assets. Umbrella insurance — also called a personal umbrella — is additional liability coverage over and above the liability limits on your underlying home and auto policies.